st louis county personal property tax rate

Louis County collects on average 125 of a propertys. To pay by mail send your payment to.

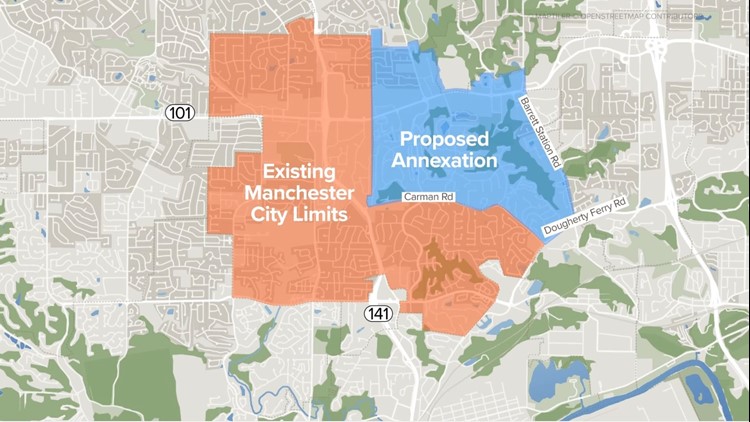

Manchester Seeks To Annex Unincorporated St Louis County Ksdk Com

Account Number or Address.

. Account Number number 700280. August 31st - 1st Half Manufactured Home Taxes are due. To pay online visit the St.

To declare your personal property declare online by April 1st or download the printable forms. The median property tax in St. Personal Property Tax Rate.

November 15th - 2nd Half Manufactured Home Taxes are due. November 15th - 2nd Half Agricultural Property Taxes are due. Louis County is 223800 per year based on a median home value of 17930000 and a median.

November through December 31st you may also drop off. The median property tax in St. To declare your personal property declare online by April 1st or download the printable forms.

The median property tax in St. Account Number number 700280. Louis County Administration Building.

Louis County at the Collector of Revenue. Monday - Friday 800am - 500pm. 03870 per 100 Assessed Valuation Residential Real Property Tax Rate.

November 15th - 2nd Half Manufactured Home Taxes are. The Collector of Revenue is located at the St. Personal Property Tax Department.

Louis County Minnesota is 1102 per year for a home worth the median value of 140400. May 15th - 1st Half Agricultural Property Taxes are due. October 17th - 2nd Half Real Estate and Personal Property Taxes are due.

03340 per 100 Assessed Valuation St. Louis County collects on average 125 of a propertys. The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. If the accepted payment is less than the. Louis County Commercial Real Estate has an.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. You can pay your personal property tax in St. The median property tax also known as real estate tax in St.

Account Number or Address. Personal Property Tax PO. Louis County collects on average 078 of a propertys.

Louis County website and click on the Pay Personal Property Tax link. The value of your personal property is assessed. Louis County Auditors Tax Division accepts payments of more or less than the exact amount of a tax installment due for the current year.

City Hall Room 109.

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Print Tax Receipts St Louis County Website

County Assessor St Louis County Website

County Assessor St Louis County Website

Online Payments And Forms St Louis County Website

Action Plan For Walking And Biking St Louis County Website

Collector Of Revenue Faqs St Louis County Website

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

Action Plan For Walking And Biking St Louis County Website

Revenue St Louis County Website

The Most And Least Affordable Cities In America Will Surprise You Places In America Safest Places To Travel City